|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pet Insurance for Cockatiels: A Comprehensive GuideCockatiels, known for their charming personalities and vibrant plumage, are popular pet birds. Ensuring their well-being is a priority for many owners, which is why considering pet insurance is a wise decision. Understanding Pet Insurance for CockatielsPet insurance for cockatiels functions similarly to other pet insurance policies. It helps cover unexpected veterinary expenses, providing peace of mind for bird owners. Why Consider Pet Insurance?

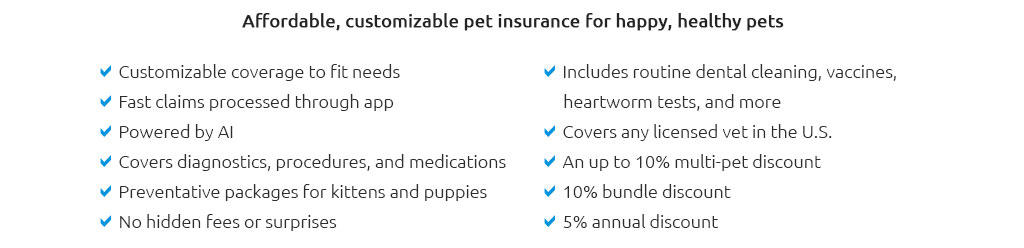

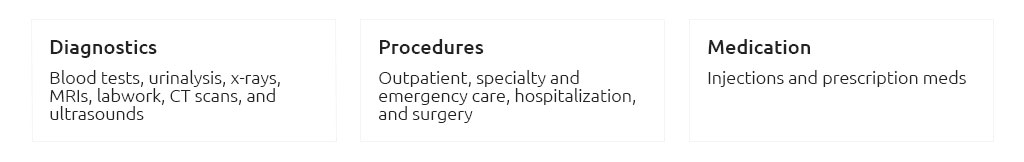

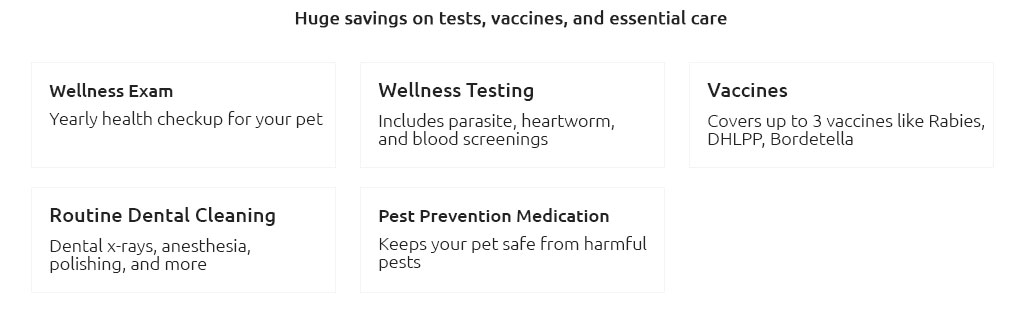

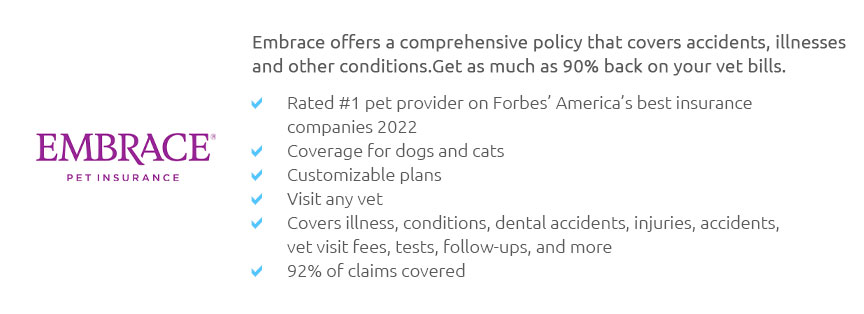

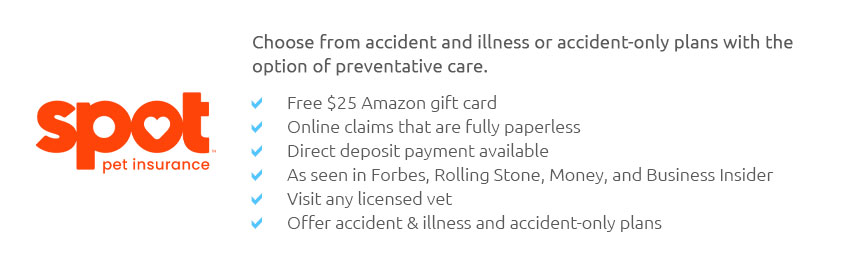

Factors to Consider When Choosing a PolicySelecting the right pet insurance requires careful consideration of several factors. Here are some key aspects: Coverage OptionsUnderstand what is covered under the policy, including accidents, illnesses, and preventive care. It's essential to choose a plan that aligns with your cockatiel's needs. Exclusions and LimitationsExamine any exclusions or limitations. Some policies may not cover pre-existing conditions, similar to those discussed in pet insurance florida pre existing conditions. Cost and PremiumsCompare the cost of premiums and the value offered by different insurers. Budgeting for insurance is crucial to ensure it remains affordable in the long term. Benefits of Insuring Your CockatielInvesting in pet insurance for your cockatiel comes with multiple benefits:

For insights into insurance for different pets, explore resources on pet insurance fiv positive cats. FAQIs pet insurance necessary for cockatiels?While not mandatory, pet insurance is highly beneficial for managing unexpected veterinary costs and ensuring comprehensive care for your cockatiel. What does pet insurance typically cover for cockatiels?Most policies cover accidents, illnesses, and some may include preventive care such as annual check-ups and vaccinations. Are there any specific exclusions I should be aware of?Yes, many policies do not cover pre-existing conditions, so it's vital to review the terms and conditions carefully. https://www.petinsurance.com/exotics/birds/

Our bird insurance plans cover conditions that specifically affect birds, from internal parasites to liver disease. https://www.petassure.com/education/exotic-breeds/bird-insurance/

Among pet health plans, Pet Assure is the best value pet plan for your Bird.It is the best pet insurance alternative and available for any type of pet. https://www.reddit.com/r/cockatiel/comments/13p7fpu/pet_insurance/

Thankfully I've only had to take my birb to the vet once and her surgery cost $500 without insurance. If your bird has a lot of health issues, I ...

|